Unbeatable loans

Can you find a better overall deal on your next loan?

No high street lender comes close to our low rate loans*

Guaranteed lower rates than the big banks

Because we’re not-for-profit, our standardplus personal loan rates are always lower than the ten major banks up to £4,999*

*Lower rates than comparable personal unsecured loans offered by TSB, Barclays, Nationwide, Halifax, Lloyds, Santander, Natwest, RBS, First Direct & HSBC. Reviewed monthly.

| Representative 10.5% APR

| Loan amount £4,500

| Term 48 months

| Monthly Repayment £114.23

| Total payable £5,478.23

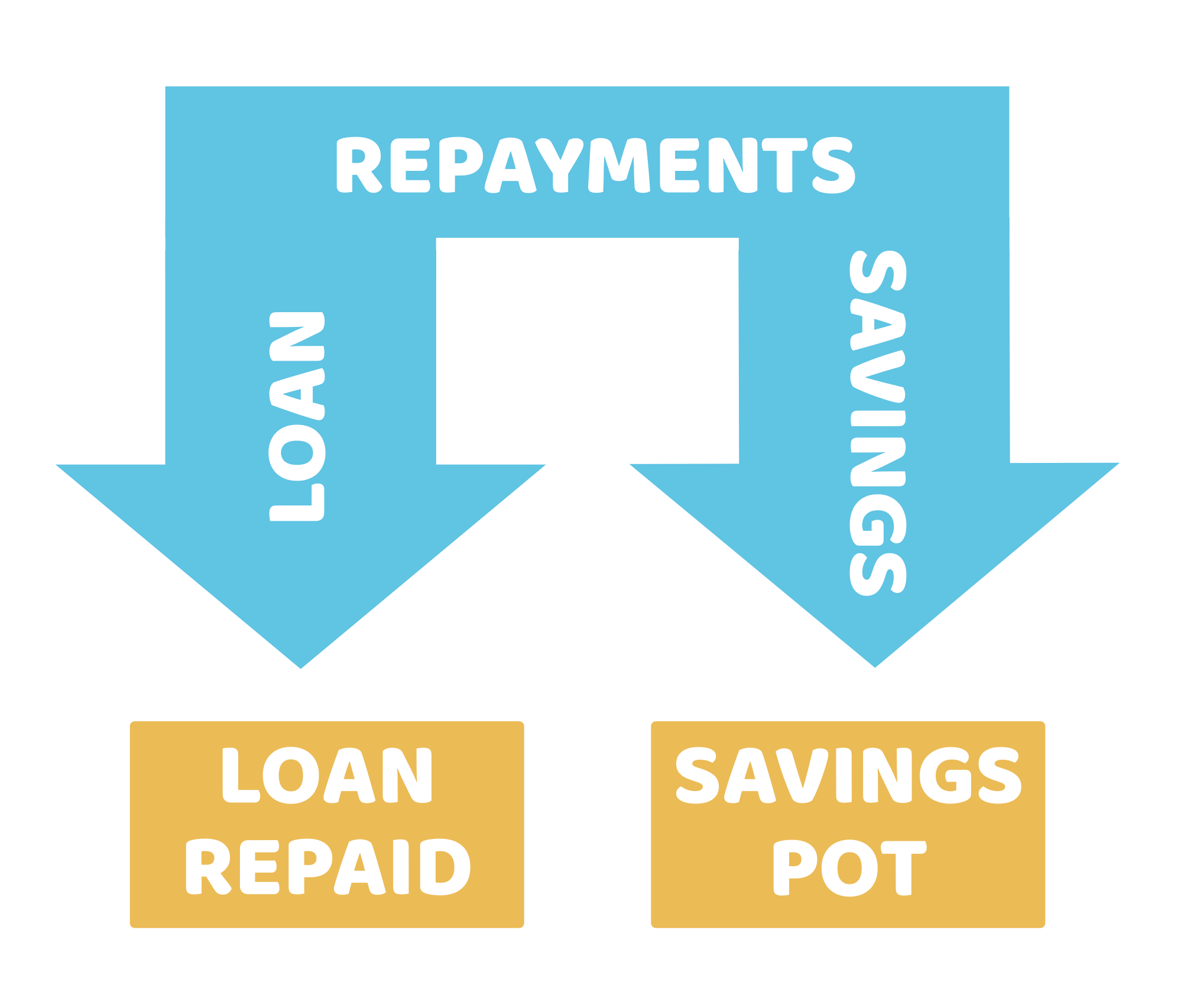

You borrow. You save

It’s what we’re known for.

We want to help you build and improve your financial well-being even when you borrow.

With every single loan repayment you make, you’ll be saving a little bit as well into your personal cashback savings account.

You won't pay any more on your loan and it won't take any longer to repay. It's just a great way to save.

Better overall

Your local not-for-profit bank has lower loan interest rates because we don’t have those big bank overheads, investors or shareholders.

Find your perfect personal loan.

We don’t do automated decisions or customer profiling. We do Loans for humans, by humans.

No other lender offers more in one perfect package.

Three-month payment holiday*

No early repayment charges

Integrated savings

Loans assessed by humans

A guaranteed lower rate than the top ten banks up to £4,999 on a standardplus loan

Representative example: 10.5% APR Representative based on a loan of £4,500 repayable over 48 months at an interest rate of 10.5% APR pa (fixed). Monthly repayment of £114.14. The total amount payable is £5,478.23. Rates vary depending on your personal circumstances. This calculator is a guide to repayments. Payment holiday for employed applicants only. All loans are subject to status and affordability. Term from 6 - 60 months maximum. We reserve the right to refuse any application.

-

Minimum age at outset - 18

Max age at loan end - 80

Minimum loan - £350

Maximum loan £4,999

Maximum loan - £15,000 when secured against savings

Employed, benefit or pension income considered

-

No penalty for repaying your loan off early

No set-up fees

Interest charged daily

Pay weekly, 4 weekly, fortnightly or monthly

Pay by standing order or direct debit

3 months payment holiday (in one go or separately) available when employed.

-

We currently can't lend to you if:

You are on contract or on zero hours

If you have had a Debt Relief Order (DRO) in the last 6 years

If you have had an Individual Voluntary Arrangement (IVA) or Bankruptcy in the last 6 years.

-

Our better overall deal means no other UK lender offers an individual loan with a lower rate of up to £4,999 plus a three-month payment holiday, no early repayment fees and integrated savings.

You will not pay back more on your loan than you would otherwise by taking out this product. Do not take out this type of loan purely on the basis of obtaining a cashback

It's all in the name

Our personal loans really are 'personal'. Every loan is assessed on its own merit by a real person.

You're not just another automated decision.

Make sure you can afford the repayments. A loan is an important financial commitment and failure to keep to the monthly repayments may result in an adverse effect on your credit rating. Always talk to us if you are experiencing financial difficulties.